On April 2nd 2025 The President of The United States introduced sweeping tariffs. Who is affected, what’s next and who benefits.

The level of new US tariffs

The tariffs are not equal, they differ across US trading partners. I divide them in 3 categories:

- “Hurt” tariffs of 10%

- “Beat” tariffs of 20-30+%

- “Devastate” tariffs of 40% and more.

Hurt tariffs

There are two sub-groups of countries “enjoying” the baseline level of 10% hurt-tariffs:

- UK & close alias in Asia-Pacific

- United Kingdom

- Singapore

- Australia

- New Zealand

- Strategic expansion countries

- Brazil

- Turkey

- Colombia

- Argentina

- El Salvador

- United Arab Emirates

- Saudi Arabia

The first sub-group are selected close allies, with the skew for Asia-Pacific. The second sub-group includes countries that are deemed strategic. Whether for internal US policy (El Salvador for the migration policy), core strategic interests (UAE, Saudi Arabia) or strategic economic expansion (Brazil, Turkey, Colombia, Argentina).

Notice absence of Japan. A closest of allies, but posing significant economic competition. One of the keys for landing in this group is not being peer competitor for the US.

Brazil is ruled by socialist president while Argentina by libertarian. Turkey, Saudi Arabia & UAE are Muslim countries. Neither personality nor ideological factors were used to qualify the countries to the “hurt” group.

Beat Tariffs

The tariffs of 20-30+% are decoupling tariffs. Such level render a lot of trade loss-generating.

They are applied to three sub-groups: 1. trade partners that are strategic economic peer-competitors, 2. countries at geopolitical risk in the likelihood of the global conflict, 3. South Africa.

- Economic peer-competitors

- European Union: 20%

- Japan: 24%

- Countries at elevated geopolitical risk

- Thailand: 36%

- Taiwan: 32%

- South Africa: 30%

Both EU & Japan are also at high risk of being engulfed in global conflict, but my suspicion is that the main reason for slapping them with the tariffs is the economic competition. Finding Taiwan & Thailand in this group is a very bad signal for the prospect of these countries being defended by the US in case of conflict with China.

South Africa is an interesting case. Their biggest trading partner is China followed by Europe. If they are seen as China’s trading proxy, they would be treated with similarly high “devastate” tariffs. But their tariffs are lower than Taiwan’s, despite recent hostile rhetoric. If the prior categories were to explain that, it may be seen as a country of importance for strategic economic expansion in the rest of the continent and thus treated softer than China.

Devastate tariffs

I consider the 40%+ tariffs as meant to devastate. They are applied to

- China: 54%

- Cambodia: 49%

- Vietnam: 46%

In case of China the purpose is clear, it’s a pure economic war. It’s meant to decouple from and to devastate China’s economy. Treating Cambodia and Vietnam with such high levels seem to follow the trade-proxy rationale.

Rationality

Despite there being rationales for different levels of tariffs, I do not believe this move is rational in any way. The belief that Brazil will suddenly be happy to increase economic cooperation because it was only slapped with 10% does not convince me.

Almost everybody will be affected by these tariffs, but despite the intention to hurt everybody else, it’s the regular US citizens who will be hurt the most,

Immediate impact – financial markets

Tariffs are not a surprise, they have been signaled for a long time and a lot of the reaction has already happened in the form of uncertainty. DJI has lost 7% in anticipation of the tariffs. As Larry Summers pointed out in his (brilliant) interview with Bloomberg, the immediate impact on the stock market is a reflection of what level the market expected compared to what level was announced.

The surprise could have been positive or negative. At the moment of writing this the surprise is negative, but this can stabilize during the day.

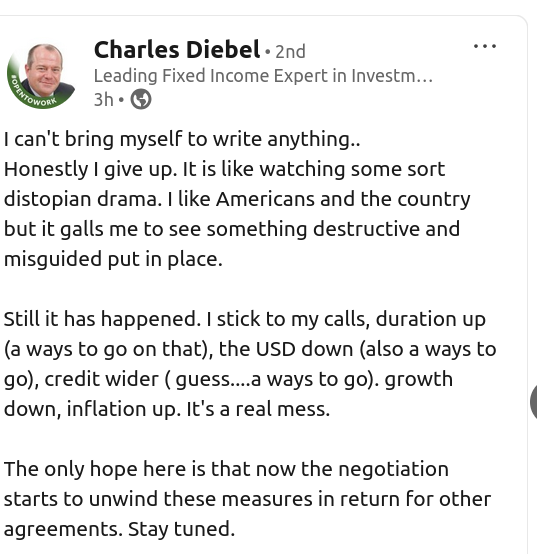

Charles Diebel, another brilliant economist summarized his anticipation on bond market and USD exchange rates this way:

Mid & Long-Term Effects

Economic activity

The impact on trade is an impact on economic activity. When things are harder to trade, there becomes less of them. This leads to inflation, unemployment, less production and less wealth. Everybody loses. We will likely see that in economic indicators, in higher prices and less activity, this can lead to stagflation (inflation & stagflation) or deplation (inflation-attended depression).

Trust

Trust is hard to build and easy to lose. The value of trust is invisible and inestimable. The basis of trust towards economic partnership with US has eroded. Even in case of 180-degree turn from US side, it would take generations to rebuild trust.

In a long run this will likely lead to capital flows from the US to more stable jurisdiction. Paradoxically Europe can be long-run beneficiary, provided that it mobilizes militarily enough to stop the Ukraine war and prevent Russia from further aggression.

Next Actions

Retaliations

I expect most countries to respond. There is a symbolic need for that. The country leader who does respond does risks internal position.

The responses will vary. The rational parties will seek responses that let the leader keep face, but on balance improves the economic / geo-strategic situation the most (or worsens it the least).

Coalitions

The coalition is a natural response to dominating entity. It is likely that trade barriers will be reduced amongst the countries and blocks affected by these tariffs and thus the trade will increase in the space outside of the US. It is also likely that the response will be coordinated broadly.

Negotiations

I don’t expect a rush to negotiations. Everyone wants to negotiate but there will be a question whether the rushed negotiations are the most effective way of achieving desired results in these circumstances.

Who loses

When global trade suffers, everybody is worse off. The tariffs are consumer tax so they will affect US consumers proportionally more than the rest.

Geo-strategically the US allies are losing far more than US competitors. The more allied the country the more it’s losing. Why? If the aliance with the US had been the strong pillar of your existence, the critical part of that has just been damaged and you feel you need to re-consider that dependence.

Who benefits

The countries that benefit from the situation are the ones that:

- suddenly become more attractive in the international markets, both for imports (will buy things cheaper) and exports (will replace US products post-retaliation).

- have not had a big trade with the US to begin with

The most apparent winner in the situation is Russia, but there are more countries in relatively favorable situation. For example Nigeria that only sends 7.5% of it’s exports to the US and will sell more oil to Europe in wake of retaliation.

Summary

April Fools’ Day is a nice tradition. We make all kinds of innocent jokes and full each-other all day. In the end of the day, nobody feels like a full.

The April Fulls’ Day 2.0 is different. Many who believed in promises of lower prices and general prosperity may mark that day as being fulled and forever forever walking with the stain of full on their faces. I hope I turn out wrong, but that’s the current prospect.

Sources: